Expert Strategies for Buying a New Home Online

The days of driving around looking for 'For Sale' signs are largely behind us, thankfully, since its a waste of your time. Today, your dream home, and most of the shopping to find it are right on your phone 📲, or at least that is the promise that is being made. But many have found its not that easy, so let's talk about some expert advice that will empower you towards mastery of house hunting online. Happy House Hunting!

Article Created by Nick & Beth, check our LinkedIn Bios for background about our experience in real estate and technology

The Problem With Home Shopping Online Today: It feels overwhelming!

Did you know, just the city of Houston has 11,000 active home listings and San Antonio has over 9,000? Across all of Dallas Fort Worth, over 42,000 homes were actively for sale in September 2025.

With so many homes for sale, how do you find the right home for you? Home shoppers consistently tell us, they still feel frustrated and overwhelmed by so many choices 😵 . The online home search process can feel especially daunting if you are a first time home buyer, but Abodefy is here to help you navigate the journey like a pro.

First, its important to know you are not alone in having these feelings, the National Association of Realtors annual survey shows the experience is not great for most of us.

While 86% of buyers (Age 26 to 44) contact a realtor when they start their home purchase process, only 21% said their realtor actually found them the home they bought. Over 60% found the home online themselves with the rest referred by a family member, friend or neighbor. Today a realtor may be required to accompany you when you want to tour a home, but new home builders are adopting services like UTour that give you more freedom to tour on your schedule. More on that below.

Despite all the tools that you have heard of (Zillow, Realtor.com), buyers still say that finding the right property is the hardest part of the home buying process, with paperwork and understanding the process second and third most difficult.

This is why we built Abodefy, because home buying is too hard and we wanted to rethink the entire process. Buying a home is too important to do it in an old-school way.

The Abodefy Difference

Home Tours

• Visit homes with or without a realtor

• 7 days a week

• 7am to 9pm

• Like a test-drive for a car

Home Warranty

Shop our homes with the confidence of a home builder provided warranty.

Get a Great Deal

We show you the competitive homes so you know you are getting a great deal.

Builder preferred lenders often offer special promotions on home purcahses

Make Your Offer

You don't need to know how to draft a real estate contract to make an offer on a home, our digital format allows you to set the terms that work for you.

5 Min. to Mortgage

The streamlined mortgage application makes this step simple.

• Easy to use on your phone

• Get an answer quickly

• Shop homes with confidence in your budget

Mortgage Deals

The preferred lender provides the builder's best deal, either on rates, closing costs or both.

Easy Home Close

All of our closings are virtual, so you can close from anywhere, while standing in you your new home or from vacation, whatever works for you.

Less Paperwork

Our contracts are electronic and digitally signed so we make it easy.

Expert Overview: Online Home Shopping Success Checklist

Step 1: Your Lifestyle Guides the Home Search

If you start your home search journey by going to a big listing service, typing in your home town and clicking around, that is a recipe for feeling overwhelmed fast. It won't be fun like shopping a well curated boutique, it will feel more like the mall during the holidays 😮💨, too crowded, and too many choices and way too expensive.

Real Estate Agent Search

At this point, you could turn to a realtor for help as many people do. Let's start there because realtors are still a big part of the process for many people. Abodefy's realtor search makes finding the right agent better by showing you a map of where Buyers agents actually have helped someone buy or sell a home. That information, hidden for so long, let's you assess if you are finding someone who really has expertise in the area you are shopping or not. But as we saw above, realtors mostly don't find the home for you, they are just a helping hand for which you pay 3% of the purchase price of the home.

One thing that a good realtor does is help you discover your taste in homes by asking guided questions. Here in 2025, there is an even better way that savvy home shoppers are starting to try, which is developing an Abodefy LifeMatch Profile using Google's Gemini AI Chat. If you want to try it, visit our 'Practical Guide to Starting Your Home Search with AI, powered by Abodefy and Google Gemini.'

Step 2: Smart Online Home Search Strategies - Navigating 100K Listings with Abodefy

Abodefy empowers your search in several powerful ways.

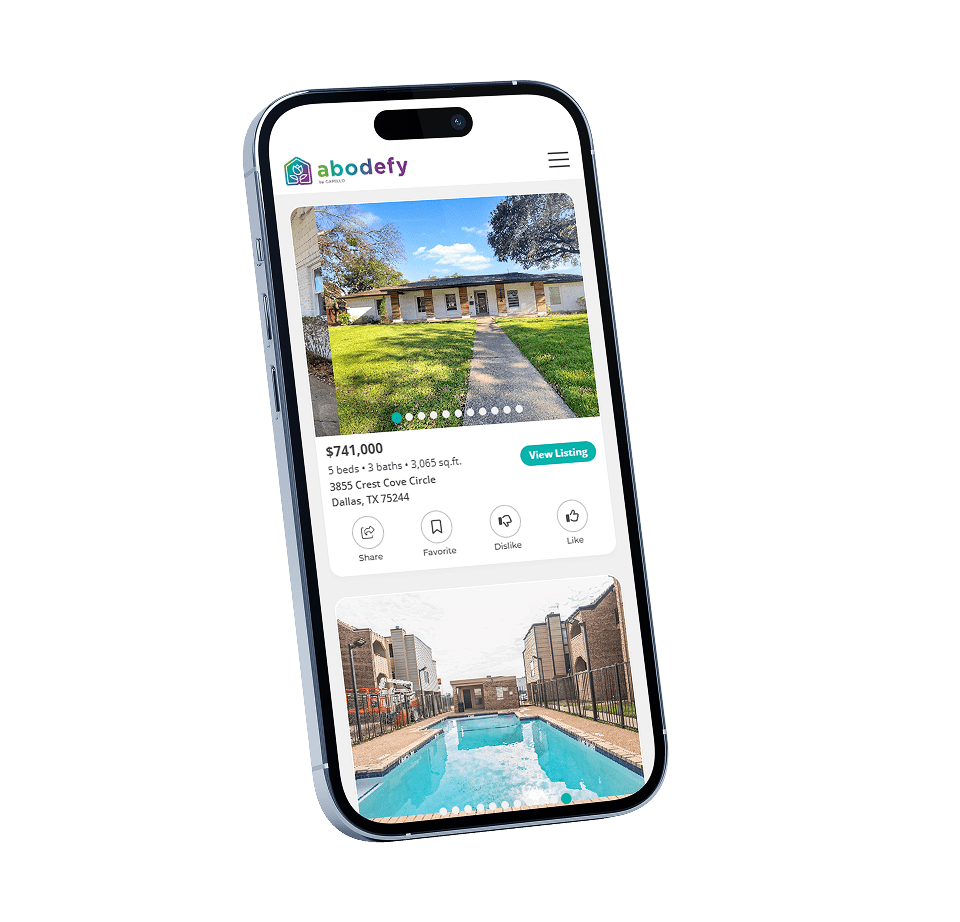

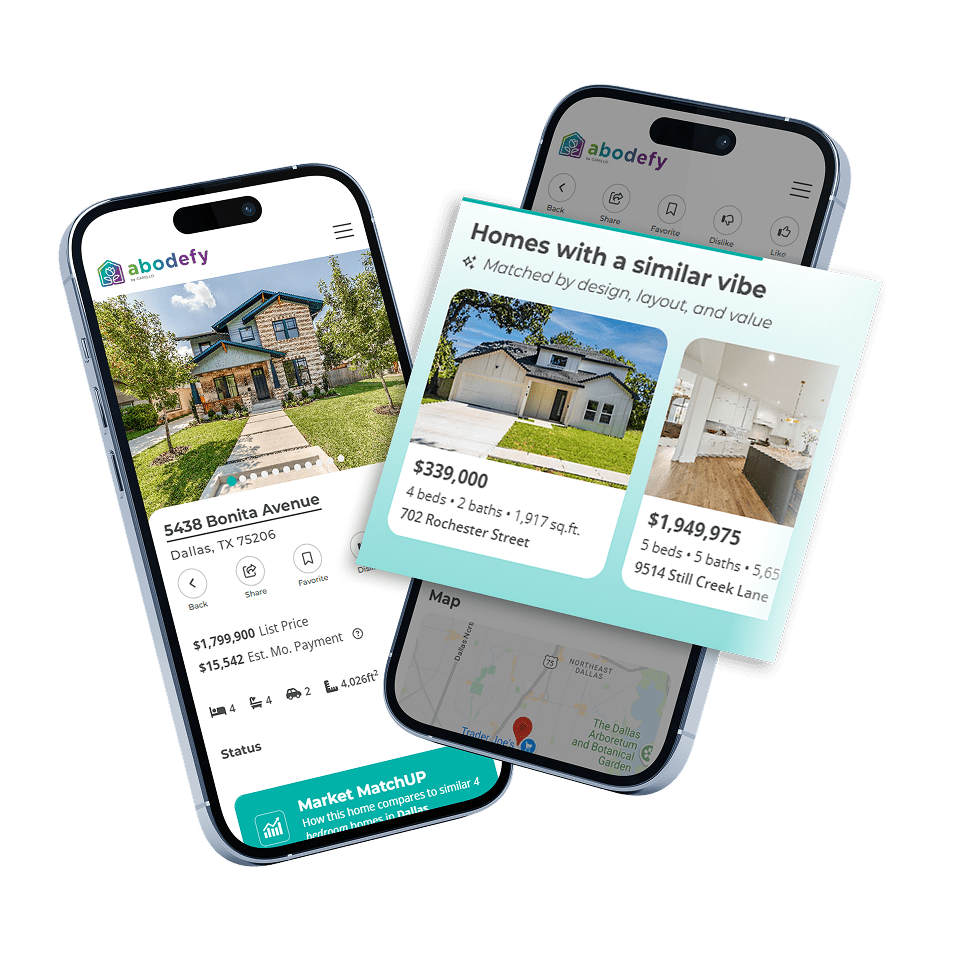

Homes with a Similar Vibe shows you homes that have similar features, and it goes way behind price and bedroom, looking at over 80 categories of home parameters to create matches. Cut through the clutter FAST!.

Abodefy's recommendations work in the background, just like TikTok and Instagram, showing you homes that match your personal taste. Its the kind of magic easy-button that makes scrolling listings a dream. Just be sure to look at enough homes to start seeing the effect. It works better the more you like and dislike homes.

In addition to these powerful search tools, Abodefy's listings include virtual tours in every home they are available for, and a link to contact the listing agent directly.

Step 3: Deep Dive Research: Understanding The Neighborhood & Beyond

Tour the Home & Neighborhood In Person, take a house "test drive"

Shopping online and 3D virtual tours are great for narrowing down your search, but for a home, nothing can match visiting it in person. When you buy a car, the key step before making a purchase is the test drive. A test drive allows you to really feel what driving that car is like, how well you can see out all the windows and if the seats are comfortable with room for your purse and pet to ride along side.

Touring a home = a test drive

While touring a home, be sure to look for signs of maintenance issues, like squeaky floors, poor and poor water pressure. When you go to contract you will get an inspection, but look closely yourself during your visit, just like you would listen to a car as you test drive.

Test drive a resale home: you can book an appointment through the listing agent, and occasionally the home you want will be available via an open house. Online real estate platforms will show

Test drive a new construction home - meet with sales: New home builders want you to book an appointment with their sales counselor on-site. The new home consultant can show you all the options and explain the options the builder offers you. If you have specific requests, the sales person is there to try to make it happen for you. The downside of this process is having to talk to a sales person, and also working on their schedule.

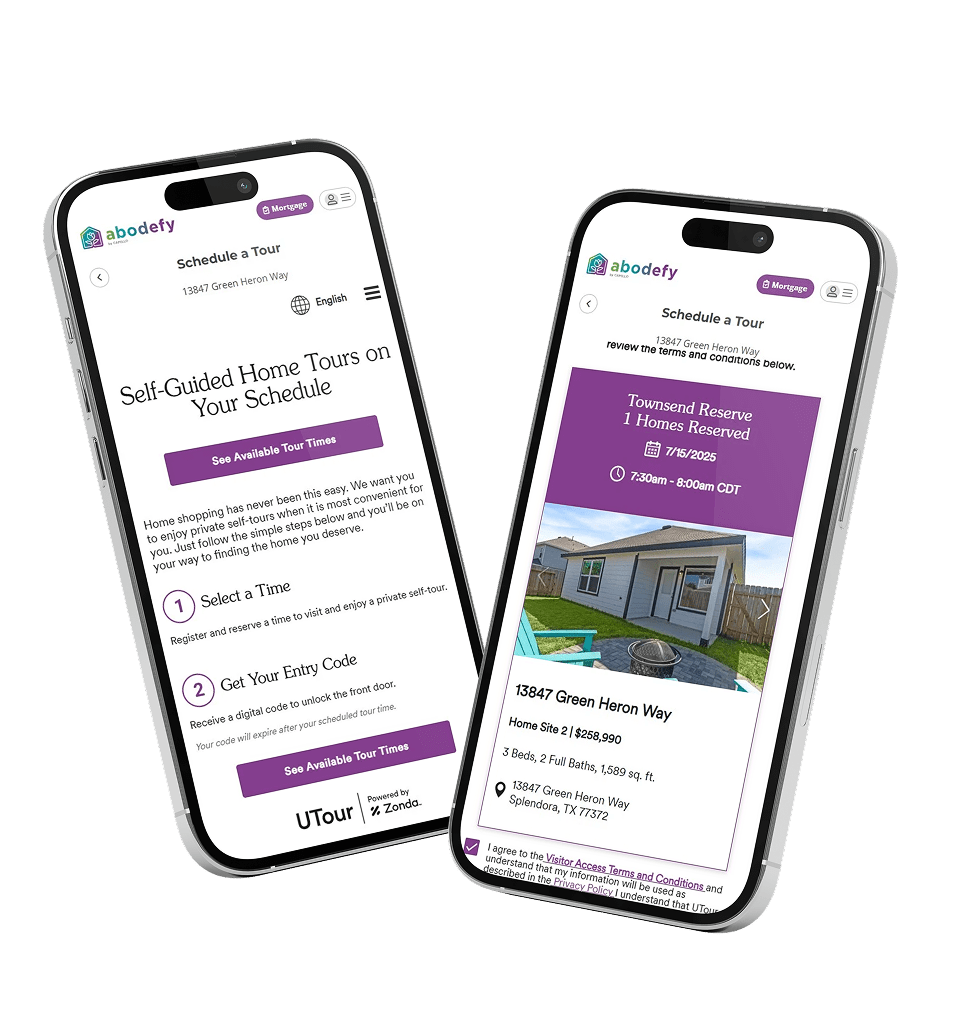

Test drive a new construction home - the modern way: Some new home builders, including Legend Homes and Abodefy are pioneering the best way to test drive homes, which is self-touring. Self touring means you can book at tour right from your phone, on your schedule, 7 days per week, usually 7am to 9pm, including holidays and weekends. Bring a friend, a family member or a realtor! If you have questions a builder representative is just a text message away.

Usually all of the builders homes are available on the app, so you can book a tour of every home you want to visit.

Visit the builder self tour site

Select a tour time & day

Create an account to verify your identity

Get a calendar reminder

At the time of your tour get a unique access code via text.

Self tours can be booked at the property itself, so you can tour right away. No pre-appointment needed, unless someone is already in the home you want to tour.

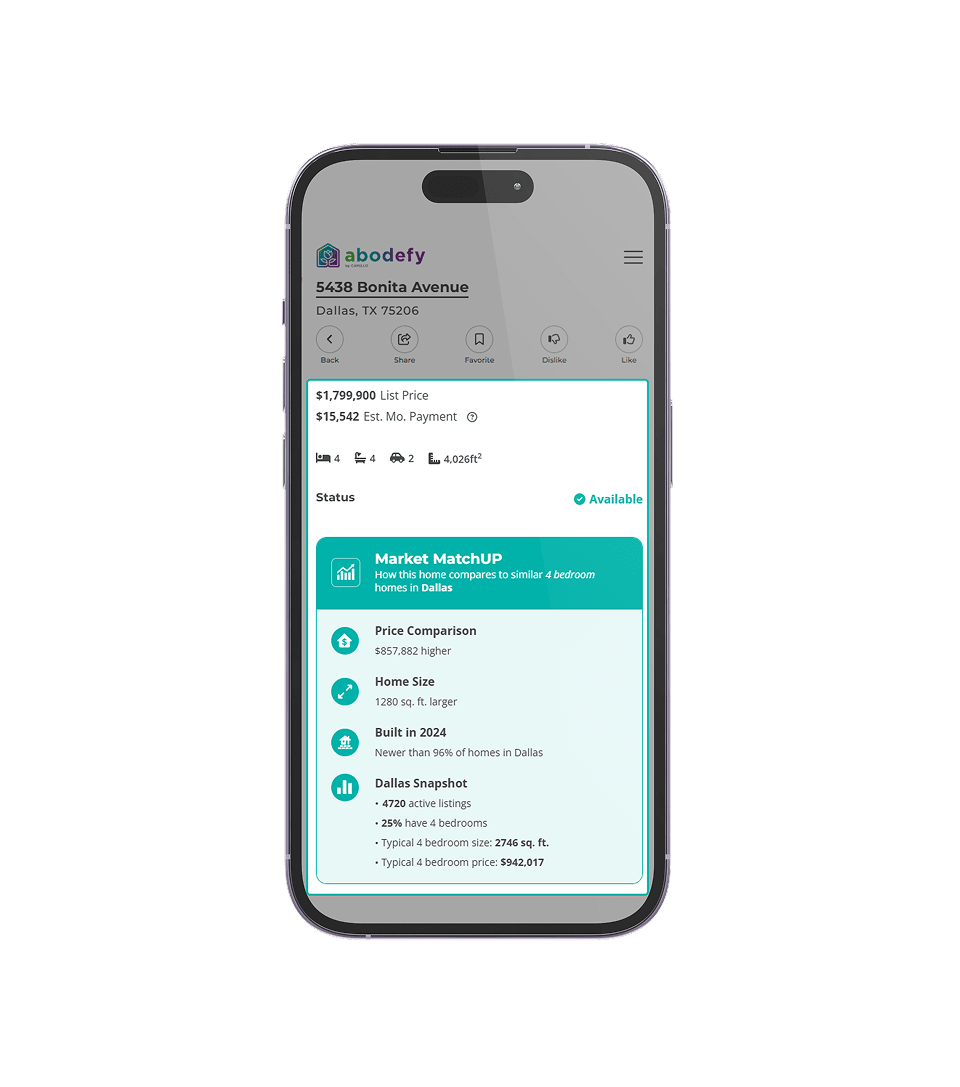

Shop the Competition

To help you know if you are getting a great deal, our neighborhood data includes the 'Market MatchUP' feature which compares the home to others in that same market to give you better context. 'Market MatchUp' and 'Homes with a Similar Vibe' and give you an insightful competitive market analysis (realtors call them CMA's) to power your online neighborhood research.

You will want other important data about the neighborhood.

Each Abodefy listing address is clickable, and will take you to Google Maps, so you can calculate directions to work, to school, friends and family and search for the nearest H.E.B. grocery store or Target.

If you are searching in a city neighborhood, we recommend the service 'Walk Score' to get a sense for neighborhood walkability to life's daily necessities. WalkScore was acquired by Redfin, but we are fans.

To learn about school districts and start your research process, some national websites provide simple grades for schools, but it is important to realize that your child will be unique and it is worth making a visit to the school. For a quick and simple, Niche.com has data to get you started.

Step 4: Set Yourself Up for Success: The Financial Foundations of a Home Buying Budget

Since homes are the most expensive purchase most of us will ever make, your purchase budget always figures significantly into the process. This is where budgeting (that no-fun word), or realistically determining your comfortable monthly housing cost (mortgage, taxes, insurance, HOA, maintenance happens.

Abodefy Mortgage Calculator to Determine Your Home Purchase Budget

The Abodefy Mortgage calculator includes a simple and an advanced mode to let you fine tune your budget exploration. This calculator includes an affordability calculation that is based on decades of best practices. We go over those financial best practices below.

You can afford a house up to

$284,886Monthly Payment This is the total payment, including mortgage, mortgage insurance, HOA fees, and property tax that will fit the affordability index target of 36%.

$1,404DTI Ratio Your Debt-to-Income (DTI) ratio is crucial for lenders assessing your loan affordability. A DTI of 36% or below is ideal, signaling a good balance of debt to income. DTIs between 36% and 43% are acceptable but higher risk, while above 43% may hinder loan approval.

36%Mortgage Amount

$269,886This calculator is illustrative, but your unique situation will best be served by seeking out a purchase budget pre-approval from a reputable mortgage provider. Abodefy's Start My Mortgage Application can provide you an approval within 48hrs.

Starting from your income and what you have saved for a down payment, our calculator provides an estimated monthly payment. This monthly payment INCLUDES many items you may not immediately consider, including:

Mortgage payment: this is the amount you borrow, known as principal, and interest, which is the money you are paying to borrow the funds the buy the home. The principal is the amount paid to the seller by the mortgage company, and the interest is what the mortgage company collects to loan you the money. When you hear about home mortgage rates, this is where the rate comes in to impact your house payment.

Mortgage Insurance: very common when buyers have less than a 20% down payment, because it protects the lender and allows you to start home ownership sooner.

Home Owners Associate Fees (if applicable): this is common in new home communities and those with established amenities

Property Taxes: many new home buyers include paying their property taxes as part of their mortgage payment. What this means is the funds needed for your annual property taxes are collected by the mortgage company in an escrow account and then the mortgage company pays your property taxes from those funds when they are due. This saves many home buyers from having to budget for extra money at the start of the year.

Debt to Income Ratio (DTI): Even if you go into purchasing a home with no debt like credit card balances or car payments, your home mortgage is a debt that you are taking on. To check that your new mortgage payment is affordable, the lender will verify that your Debt to Income Ratio including the mortgage is 36% of your income or lower. The lower that DTI is, the more comfortable making the payment every month will be. As long as the piggy bank in the image is green on our calculator, you are OK. You can adjust the slider and it will turn yellow or red.

Using Your Current Rent To Estimate Your Budget

What many people do to set a home buying budget is look at their monthly rent as a starting point, because that is an expense they are comfortable paying. Its a great shortcut, but there are many differences between a rent payment and a mortgage payment, so let's highlight a few of them.

Buying a house means paying yourself, not a landlord: A portion of your mortgage payment goes to principal, which is the amount you borrowed to buy the home. When you pay principal, that is the same as paying yourself. In the first years of a mortgage, you are mostly paying interest, but as time goes by on your mortgage, more and more of your monthly payment pays down principal, which is essentially your money.

Owners pay for maintenance: Rent often includes some maintenance costs, whereas homeowners pay their own maintenance costs. A big one that catches many homeowners off guard is lawn mowing, since your new grass will grow really fast.

Property Taxes & Insurance: Paying property taxes is one of the unpleasant parts of home ownership, but it also means you are invested in your community and you are really a part of something big. The schools, roads, police and fire support are no longer an abstract concept, but something you contribute to every year to live in a nice place. Homeowners insurance is the same, you made a big investment, and homeowners insurance is your way of protecting that investment in the event of something catastrophic.

To Get a Mortgage Pre-Approval Before You Find a Home or After... that is the Question that Shakespeare Never Asked but Matters For Your Home Search

A mortgage pre-approval simply means that a mortgage lender has looked at your financial history and can approve you for a mortgage up to a specific budget.

The Benefits of a Mortgage Pre-Approval is Home Shopping Rizz

You know exactly what your budget is, and you have powerful friends vouching for that fact, that's confidence, that's charisma.

No matter what actual amount your pre-approved budget is, its a big deal and something you should be proud of.

Shopping Re-Sale Homes, a Mortgage Pre-Approval is a Must Have

Put yourself in the seller's shoes, you are letting a stranger into your home. To do that, you want to know that person is a serious buyer who can afford the home.

For you, it means that if you love the house, you can move quickly before someone else makes an offer. It only takes a few minutes with the Abodefy Pre-Approval Application, and you can do it right from your phone. You get a basic yes / no in less than a day, and a full pre-approval letter in as little as 48 hours.

Abodefy's mortgage partner can help you get a mortgage on ANY home in Texas, and they are experts at working with you to find a path to home ownership that you can afford.

Shopping New Construction Homes, Shop the Mortgage Deals from Your Builder

Many new home builders, including Abodefy and Legend Homes have mortgage bank partners who will help you during your home purchase to get you the best deal. Builders have a relationship with a mortgage company because financing is such an important part of the home buying process. The builder's mortgage resource is very well versed in the builder and their job is to make sure you get into that home, so they often can be very creative in working with your situation.

Examples of how a builder's mortgage resource can help you:

Closing Cost Assistance

Mortgage Rate Buy-Downs

Partnering to Achieve Your Desired Closing Date

New home construction has many advantages, including a home builder warranty that gives great peace of mind, and financing assistance is another.

To learn all about Abodefy's financing process, read about Financing with Abodefy, and click through to the mortgage application. It takes less than 5 minutes to complete.

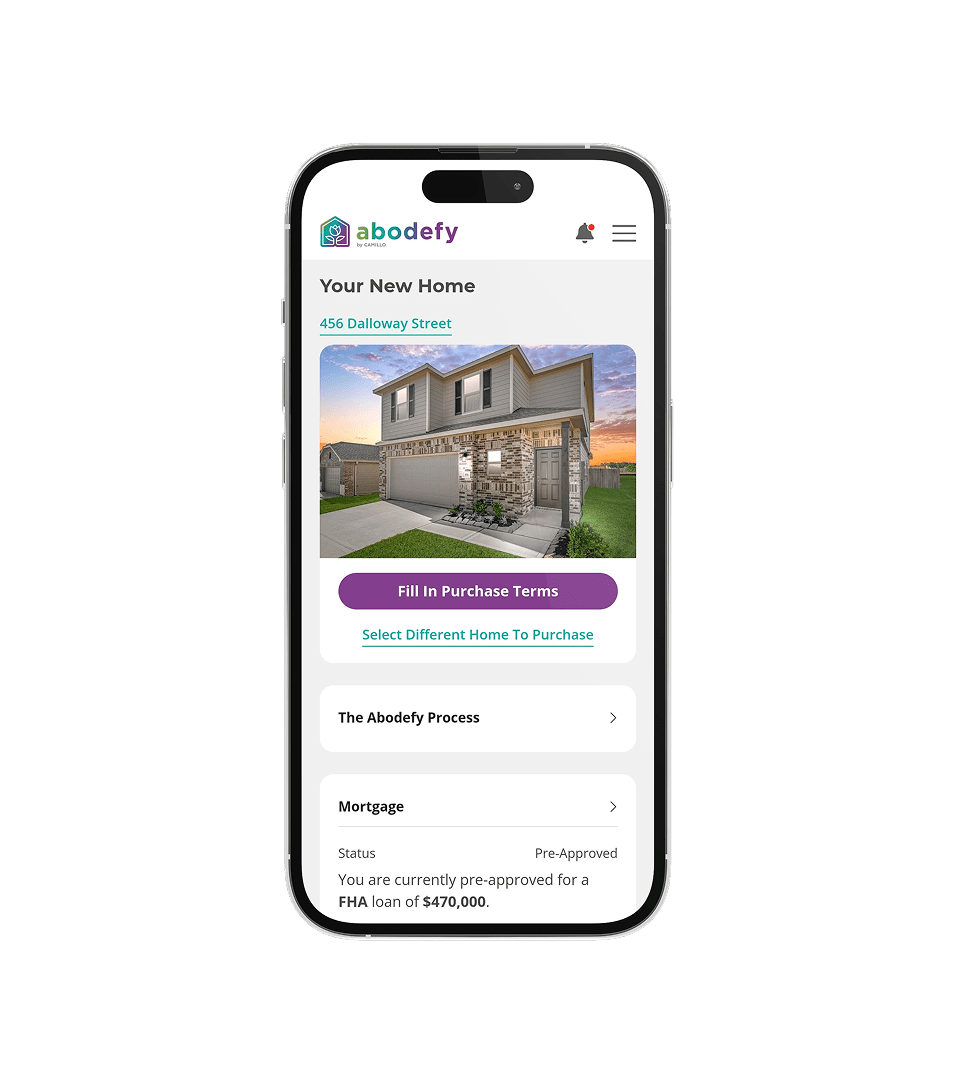

Step 5: Preparing for Next Steps - Making a Home Purchase Offer and Home Closing

Making an offer for the home is the finish line of the shopping process, but its the starting line of the home purchase process. Abodefy has built the smoothest most transparent process for making a home purchase offer and has the smoothest closing process in the industry. Abodefy Showcase homes offer an online closing process second to none.

We will keep you, your realtor (if you have one), your home builder and the mortgage company all up to date on the next steps to keep the process moving seamlessly and stress free.

The Abodefy Difference, Explained

We’ve all gotten comfortable with ordering home goods, clothes, and even groceries online. In recent years, the online car market has taken off and made buying a car more convenient. But is buying a house online, from your phone really possible? Abodefy is answering that question with an affirmative YES!

Truly Buy a Home Online

Sure, there are plenty of home sites like Zillow and Realtor.com that are fun for browsing homes to explore, but what happens when you find a home you are really interested in? If you like the idea of touring that home on your own and completing the purchase online, Abodefy offers a true Buy Online From Home option. Our site lets you take your shopping to the next level with features like applying for financing, self-guided tour booking, and click-to-buy.

Search Homes Across Texas

We've made getting started easy with our maps of three major Market Areas in Texas: Dallas/Ft. Worth, Houston, and San Antonio.

Abodefy has built the most powerful search capabilities in residential real estate. We are a special combination of tech and real estate experts.

Your chosen map will show every home available in that area, so you can shop the entire market right from your phone. You can zoom in to get as specific as you want within each map.

If you see a home you like, and want to see similar properties, you can return to the map to refine your search or simply choose our More Like This option.

The first step to successfully shopping for the right home is to give some thoughtful consideration to all of the various types of communities, floorplans, and options. There are an infinite number of choices, so documenting down to the details will help to narrow your views as you shop. As you refine the features you want in a home through more like this, Abodefy is logging the features behind they scenes. You can save that search by creating an Abodefy Profile.

But more than just shopping, Abodefy Homes have online tour booking for homes that interest you, just like test driving a car at the dealer, except with no salesperson following you around.

The last thing you want to do is spend time shopping and find a house you absolutely fall in love with only to find out it is out of your price range. Getting pre-approved for financing will help you avoid this common mistake and put your mind at ease to enjoy the shopping experience fully. If a house is priced competitively, it could sell very quickly so you want to be as ready as possible to purchase once you find the house of your dreams.

Once you complete your loan application and receive a pre-approval from the lender, you can take a moment to celebrate as you take the next step of making an offer on your dream home. The builder will also be notified of your pre-approval and ready to create a purchase agreement based on agreed upon terms. The builder will send the prepared contract to your portal so you can sign it digitally. Once you sign the purchase contract, the property status will change to “In Contract” and it will no longer be available for any other buyers to purchase.

Congratulations, you are on your way to becoming a homeowner!!